Do you want to diversify your investments and invest in one of the most stable real estate crowdfunding platforms out there? EstateGuru is for you! In this EstateGuru review, we will go into the details of the platform, and you will learn everything you need to get started.

To further diversify my investments, I started investing in EstateGuru in 2019. I regularly invest in new platforms to try them out and see how they work. I like EstateGuru, and they’re my go-to real estate crowdfunding platform now.

If you want to build your wealth, try investing in real estate. If you are hesitant and don’t know where to start, this article can help you with ideas on property investing and real estate investment in general. This is an investment opportunity if you have extra cash or you want to have extra money for yourself and your family.

When you think about real estate investing, the first impression is that you need to have a bag of cash to enter the housing market. But investing in property is not that complicated. You just need to have a good investment strategy to succeed in property management. And, EstateGuru can help you with that!

To learn more about EstateGuru, continue reading and learn about its features, how it works, and the pros and cons of the platform.

EstateGuru during COVID-19 – real estate investments are among the most secured P2P investments because they are backed by property. I am still investing in EstateGuru myself. I temporarily analyze projects to ensure that I don’t invest in high-risk projects (restaurants, hotels, for example). Because EstateGuru has a good LTV (average 60%), properties can decrease by 40%, and investments will still be protected. Currently, my portfolio is performing as expected, and there have been no defaults on the platform since 2020.

What Is EstateGuru?

EstateGuru is a European real estate crowdfunding platform for property-backed loans provided to businesses. That means loans on EstateGuru always come with a property as an underlying asset, which makes it safer for investors to invest in their loans.

EstateGuru is growing incredibly fast and has become one of the biggest crowdfunding platforms in Europe. The platform is located in Estonia, a place where many crowdfunding or P2P lending platforms are.

Since its founding in 2013, EstateGuru has lent over €403 million in funds divided over 2,561 loans, which means the average loan size is over €157,000. These numbers come down to €30 million in earnings to the 90,000 investors from over 106 countries.

The historical return of EstateGuru is almost 12% – which is on par with other platforms like Mintos!

EstateGuru lends to business owners and developers. Developer loans have the goal of providing a bridging loan or funding an entire property project. Business loans aim to provide capital, which is secured on residential properties (houses) or commercial properties (like restaurants or hotels).

Currently, most loans are issued in the Baltic countries (Estonia, Latvia, and Lithuania). EstateGuru is now also active in Finland, Germany, Portugal, and Spain.

All loans at EstateGuru are backed by real estate collateral; when a project defaults, the underlying real estate can be sold. While their total default rate is 2.7%, resulting in €0 capital loss for their investors. This is a great result and is incredibly good for the investors.

Check out the below video of how EstateGuru works:

Features Of EstateGuru

EstateGuru has a lot of features to check out that can help you as an investor. Let’s take a look at some of them.

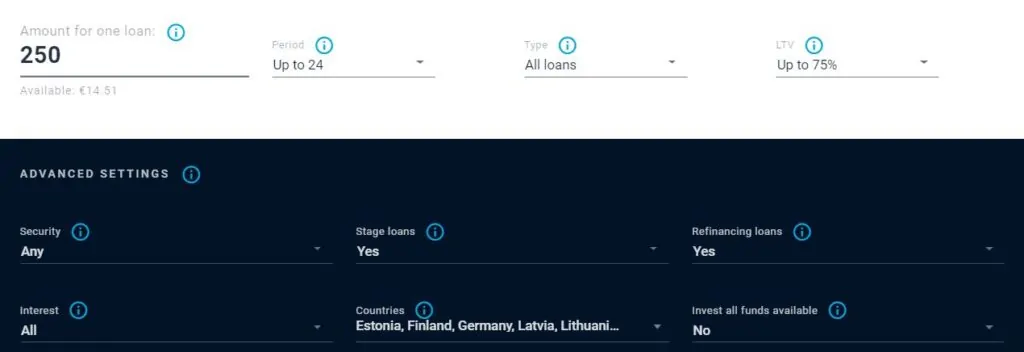

Auto-Invest On The EstateGuru Platform

When investing in EstateGuru, you can decide to invest manually in each loan or use the auto-invest functionality. Personally, I would recommend auto-invest. EstateGuru has many different loans, making it a great option to spread out your capital as much as possible.

You have two types of auto-invest available:

- Basic: between €50 and €250 per loan

- Advanced: over €250 per loan

When you invest in the basic auto-invest functionality, you can invest between €50 and €250 per loan. You can decide what period you invest in, what type of loan you want to invest in, and the loan to value (LTV) you’re interested in.

The choices when investing €50 per loan look like this:

If you’re investing above €250 per loan, you can also use the advanced settings. You can choose your target interest rate, what countries you want to invest in, whether you wish to include stage loans or refinance loans, and whether you want to invest all funds available.

For auto-invest users, you may check this guide:

- €200 or more, investors get an additional 0.5% annual interest bonus.

- €1000 or more, investors receive an enhanced annual interest bonus of 1%.

- €5000 or more, investors maximize their returns with an impressive 2% annual interest bonus!

It is very easy to set up its auto-invest tool:

Manual Investing On EstateGuru

Manual investing in the EstateGuru platform is straightforward and quite simple. There is no overload of investment opportunities. I would say there are between 0 and 3 loans available on most days.

For manual investments, you may check this guide:

- €1000 or more: Investors enjoy a 0.5% annual interest bonus.

- €5000 or more: Investors get a 1% annual interest bonus.

- €50,000 or more: Investors receive a 2% annual interest bonus.

When you check their homepage, you can filter on available loans, fully invested loans, or already funded loans. You can only invest in the available loans at any given moment.

Secondary Market On EstateGuru

EstateGuru has a secondary market on its platform. Over 90,000 investors on the platform may want to buy and sell their investments before maturity.

Introducing an early exit option to the platform is positive for you as an investor. It increases the liquidity of the investment because you can cash out at any time.

Of course, a secondary market is no guarantee that your loan will be sold within minutes.

On the EstateGuru secondary market, there is a 2% fee for the seller. As a buyer on the secondary market, there are no fees involved.

When you look at the secondary market, you can filter on price, filter on the remaining period, or filter on expected return (AROI) – which includes the discount or premium on the loan.

This is what the secondary market looks like:

Support

On weekdays between 9 am and 6 pm, there is a chat functionality on their website available. Whenever I had a question, they always returned to me on the same day – mostly within 30 minutes. They are pleased to answer your questions, and they are very knowledgeable.

EstateGuru is a serious platform that values its investors and wants to help them with any questions they might have. They want the best yields and the most profitable investment property for their customers.

Creating An Account

The first step to becoming active on the EstateGuru platform is to open an account. The website is user-friendly, easy to use, and well-designed. It comes in English, Estonian, Latvian, German, and Russian.

They make it relatively easy to open one in under 5 minutes. This includes a KYC procedure where you need to provide an identification document.

Once you open your EstateGuru account, you can deposit money. Within two days, the money I transferred was in my account.

I withdrew a small amount of money from the platform to ensure that everything worked well on that side. There were no problems, and I got my money back in my bank account in 2 days.

To make it easy for you, here are the steps in registering in EstateGuru:

- Should be at least 18 years old

- Have a European bank account (EEA member states or Transferwise for global investors)

- Fill up contact information.

- Account verification (KYC section required for anti-money laundering laws)

EstateGuru is currently giving 0.5% cashback to you on any investments you make within the first 3 months if you sign up using our link.

💸 Sign Up With EstateGuru Here

Loans On EstateGuru

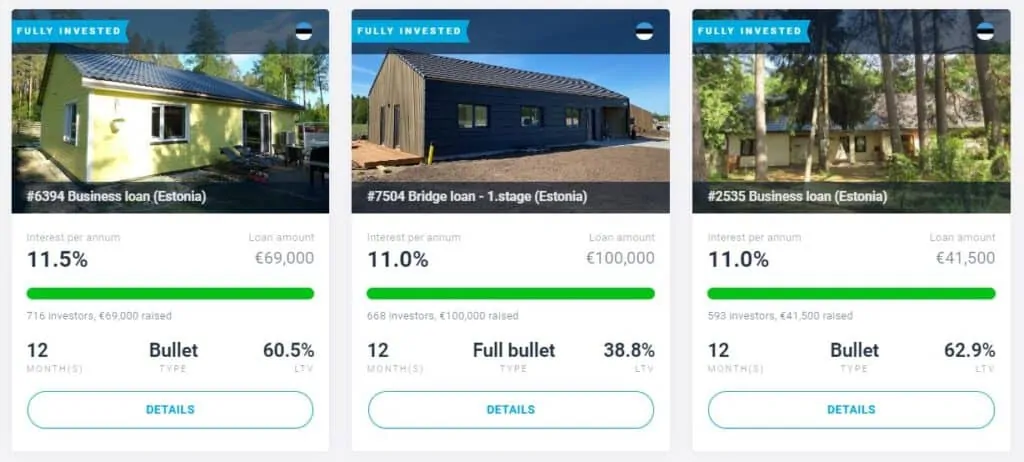

Now you’re signed up for the platform, you can check out available deals. Most of the loans on EstateGuru are short to medium-term, meaning that they range from 12 months to 24 months.

The good thing is that with short to medium-term loans, you will get your money back faster and can invest in many different projects over the years.

With EstateGuru, the property has a guarantee when the borrower can’t pay back the loan amount. They sell the property, and the money they get goes straight to the investors. In the history of EstateGuru, they have lost €0 in funds on the 2.7% defaulted loans – which are incredibly low numbers!

The average interest rate on the EstateGuru platform is 11.8%, which is very great for a real estate crowdfunding platform.

Here is a sample of the current primary market:

When you click on a single loan, you can get more details and dive deeper into the specifics. The platform usually has loans bigger than €50,000, and every loan has very detailed information.

Because the loans on EstateGuru are more extensive, they can give a lot of attention to every single borrower. This means they display all the info you need as an investor to make an informed decision.

They are presenting a LOT of info to feel comfortable investing in the project since you know all the fundamentals.

Most loans on EstateGuru are between 12 and 18 months. Depending on their payment schedule, they’ll either pay interest regularly and pay principal at the end of the loan (bullet payment) or pay both interest and principal at the end (full bullet payment).

Here is the information as you can find it on their platform:

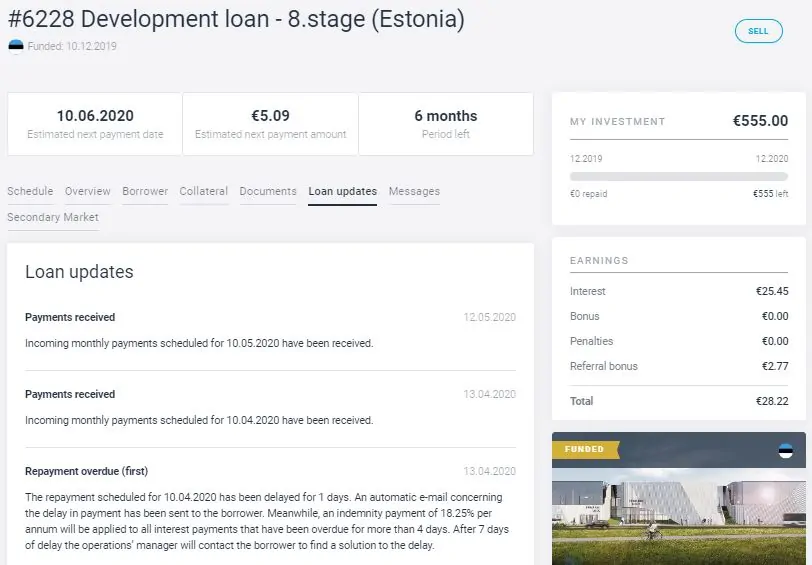

Loan Updates

EstateGuru gives a great amount of information to you as an investor on their platform. Besides that, regular updates about loans are done on their platform after you’ve invested in a loan.

I’ve seen many platforms that don’t share much information after the money is invested. EstateGuru does things differently. They keep you informed about what the current situation is.

Below you can see that one of the loans had a delay in April. Immediately after discovering the late payment, they sent a message to the borrower and let the investors know.

It is great to know that the platform is on top of every loan and doesn’t let the borrower get away with late payments.

Here you can see the details:

Buyback Guarantee On EstateGuru

The loans on EstateGuru do not come with a buyback guarantee. That means every now and then. Loans will default. At the moment of writing, 2.7% of loans are in default. Because the loans are backed by property, EstateGuru has lost €0 in funds – which is great.

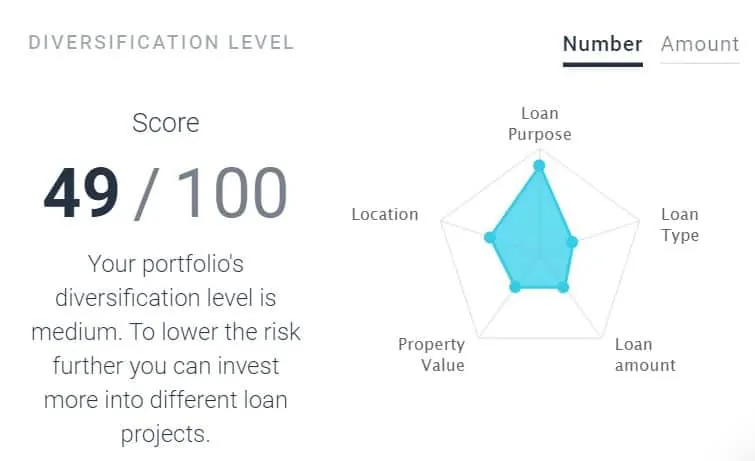

When you don’t have a buyback guarantee, it is best to diversify your investments. This means you should invest in multiple projects and diversify based on these criteria:

- Loan Purpose

- Location

- Loan Type

- Property Value

- Loan Amount

On their platform, you can see how diversified your portfolio is:

EstateGuru Pros & Cons

Now that you are familiar with how EstateGuru works, let’s get to the pros and cons of the platform.

Pros Of EstateGuru

- High-interest rates

- Very detailed information was provided about the collateral and borrower

- All loans are property-backed

- Auto-invest available

- Secondary market available

- Projects in several European countries

Cons Of EstateGuru

- Limited auto-invest settings under €250

- The majority of projects are in the Baltic region

- The secondary market isn’t free for the seller

Is EstateGuru Safe To Invest?

In this EstateGuru review, we also want to know how safe the platform is. This is a very important aspect to consider when investing. You need to know how safe and secure EstateGuru is. You don’t want your long-term goal of financial freedom to be jeopardized due to some technical issues with the platform.

EstateGuru has been in the business since 2013 and is one of the cleanest P2P lending platforms. This bodes well in terms of the security of your portfolios. They conduct thorough due diligence on each loan. They have a policy wherein an applicant needs to provide collateral to have the protection of the loan.

Other P2P Investment Platforms

Aside from EstateGuru, you may consider other P2P investment platforms. Below are some suggestions that you can try now!

Mintos – largest P2P investment platform in Europe, with over 50 lenders available, and a wide range of investments.

Read my full Mintos review here.

Reinvest24 – Reinvest24 is a property crowdfunding site where you can receive income from growing property valuations and renting out properties.

Read my full Reinvest24 review here.

Go here for a more detailed comparison of several different real-estate crowdfunding platforms.

[Related Read: Best P2P Cashback Sign-Up Bonus For You]

My Returns On EstateGuru

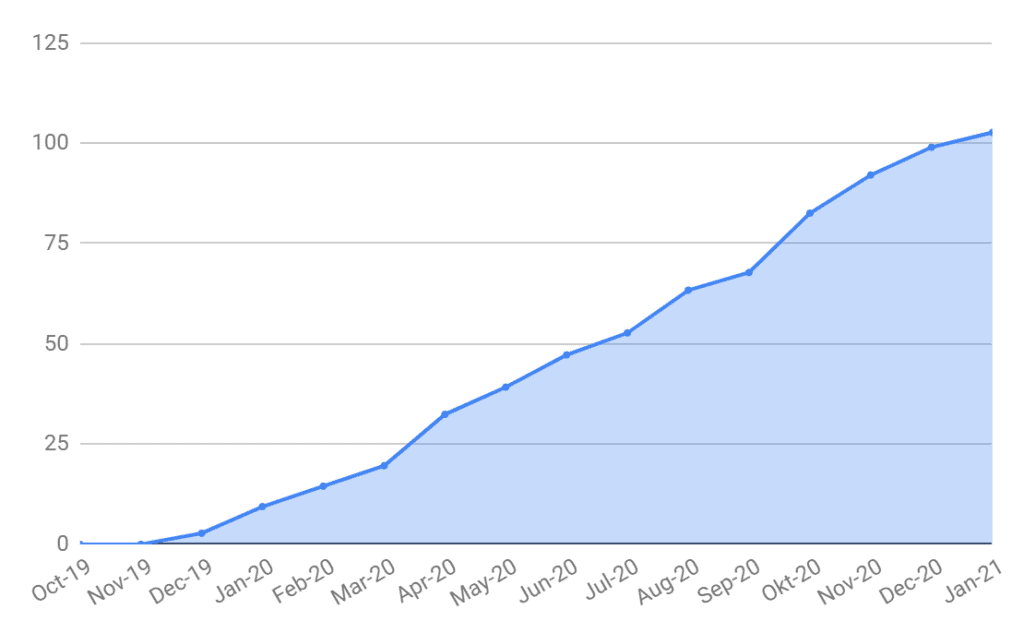

Let’s go straight into the juicy part: my returns on EstateGuru. I’ve invested over a year on the platform, 15 months to be exact. I’m currently invested in 20 different projects that are all still current.

Given that the economy took a nosedive in the last couple of months, I’m positively surprised that my investments in EstateGuru are still performing so well.

My forward yield estimated by the platform is 11.20%.

I also enjoy measuring my actual results from the platform and making it visual. Here are my gains since I started investing in October 2019:

The returns from EstateGuru are steady and growing. I’m reinvesting my returns back into the platform, which will make for more growth as we continue down the line.

I am very satisfied with my returns on the platforms at this moment.

💸 Sign Up With EstateGuru Here

Frequently Asked Questions – EstateGuru Review

If you want to consider EstateGuru and need more clarification. Here are some frequently asked questions to help you.

How Do You Invest In EstateGuru?

You can start investing in EstateGuru at €50 in a single real estate project. You can choose available projects in the platform once all are checked and approved by experts. When a new project is released, it will be visible to all its investors.

You have the freedom to choose which projects you would like to invest in and how much you want to invest. You have the power to select how to invest in their platform. So choose wisely!

What is LTV?

Loan to Value or LTV is the ratio of the loan and the property’s current market value. So let’s say a house value is €100,000 and you want to borrow €60,000, LTV will be 60%.

How do you calculate it? Simply divide the amount borrowed by the current market value of a property in percentage.

In EstateGuru, the LTV rate can be as high as 75%, and on average, it goes down to 60%.

Does EstateGuru Offer Promo Code?

EstateGuru is currently giving 0.5% cashback on any investments you make within the first 3 months if you sign up using my link.

If you would like to receive this 0.5% bonus, sign up using this link to EstateGuru.

💸 Sign Up With EstateGuru Here

Conclusion: EstateGuru Review

With EstateGuru, it is easy to diversify your investments on its platform, which means growth over time. In a couple of years, your investment with EstateGuru may become a steady stream of passive income.

This is the long-term goal, right? Have diversification in your portfolio so that you make money to meet your financial goals in life.

Try out EstateGuru; it’s a simple way to start a real estate crowdfunding portfolio with one of the best platforms currently out there. You can also use EstateGuru to diversify your current peer-to-peer portfolio with property-backed loans and relatively short-term.

Are you invested in EstateGuru? How do you like their platform?

Like the post? Save it for later!

Founder of Spark Nomad, Radical FIRE, Journalist

Expertise: Personal finance and travel content

Education: Bachelor of Economics at Radboud University, Master in Finance at Radboud University, Minor in Economics at Chapman University.

Over 200 articles, essays, and short stories published across the web.

Experience: Marjolein Dilven is a journalist and founder of Radical FIRE, a personal finance platform, and Spark Nomad, a travel platform. Marjolein has a finance and economics background with a master’s in Finance. She has quit her job to travel the world, documenting her travels on Spark Nomad to help people plan their travels. Marjolein Dilven has written for publications like MSN, Associated Press, CNBC, Town News syndicate, and more.

1 thought on “EstateGuru Review 2026 – Is EstateGuru Still Safe?”