Are you having trouble checking and monitoring your finances? Are you one of the people who badly need help in this area? This is where Mint comes in! In this Mint review, we’ll show you how this app can help you get on top of your finances.

Monitoring your financial health is one of the more important steps in achieving your goals, and Mint can help you with that. In this article, you will learn more about the Mint app, why people are so into it, and why it is the best app for budgeting.

What Is The Mint App?

Let’s start with, what is the Mint app? Mint is a free budgeting app to oversee your finances in one place. Say goodbye to messy papers and different monitoring tools, Mint shows you where your money goes.

Mint is a platform with over 15 million users and is the most straightforward personal finance program there is. All you have to do is sign up and add your accounts.

You can register up to 10 accounts such as banking, credit cards, loans, investments, and more. After the initial sign-up, Mint will download your financial data to put it all on their platform.

Mint updates your financial information every time you visit their site to show you your latest financial standing. It comes with graphs and charts to provide you with a visual representation of your finances.

Mint has different functions such as budgeting, creating goals, monitoring expenses, and saving money. Its dashboard is made to provide an overview of your finances in one setting, making it easy to see where you stand and where you’re going with your finances.

What a great app indeed!

Mint Features

Mint has many features that are quite useful for its users. And it does not require a complicated process to monitor and connect your financial accounts. Take a look at these services that you can use when you decide to use Mint.

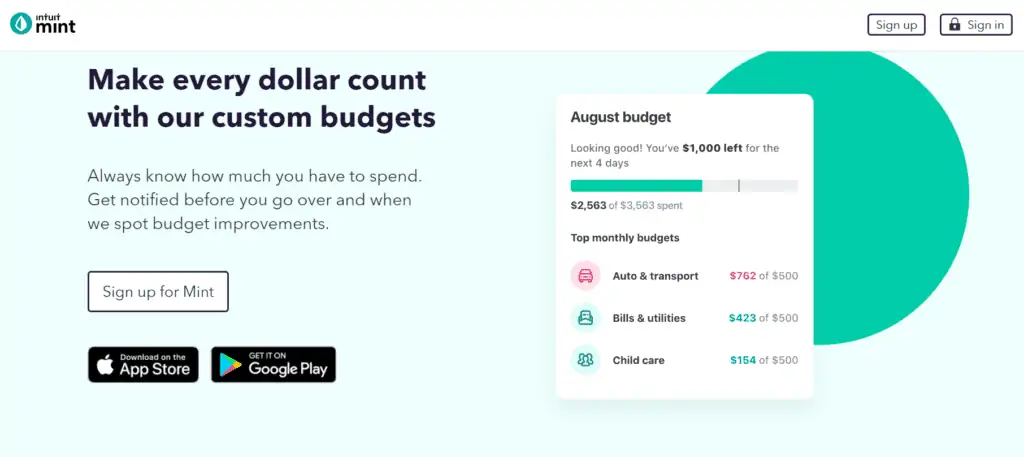

Budgeting And Tracking

Budgeting and tracking expenses are the primary tasks of Mint. These features utilize the synchronization of all your transactions and create the right categories to manage your finances efficiently.

This feature also has sliders to match every penny you have spent on a percentage-based budget, which is handy for those who are looking for an app to help them manage their spending habits.

The only downside of this feature is that when you are not quite active in accessing Mint, your data won’t be updated, and thus this budgeting tool can’t track your development. So be sure to check in from time to time and avoid delays in your financial goals.

Organizing Goals

This is perfect for those who are struggling to keep up with their goals. The feature allows its users to set up purchasing limits and set targets for paying debts, credit cards, or saving funds for a specific goal like a down payment on your home, a car, gadgets, and more.

Whatever goals you have, big or small, you can easily achieve them by using Mint.

Trends

After a month of using the Mint app, you can now go over the different trends in your purchasing habits. Plus, you can use the app for organizing goals, budgets, and expenses. Mint lets you use the data the way you want it and how you want it.

In addition, you can adjust the way your grid looks based on whatever works and makes more sense for you. For instance, having a graph for your expenses could help you pinpoint where you spend your money the most. In that way, you can re-evaluate your costs and make the necessary adjustments as needed.

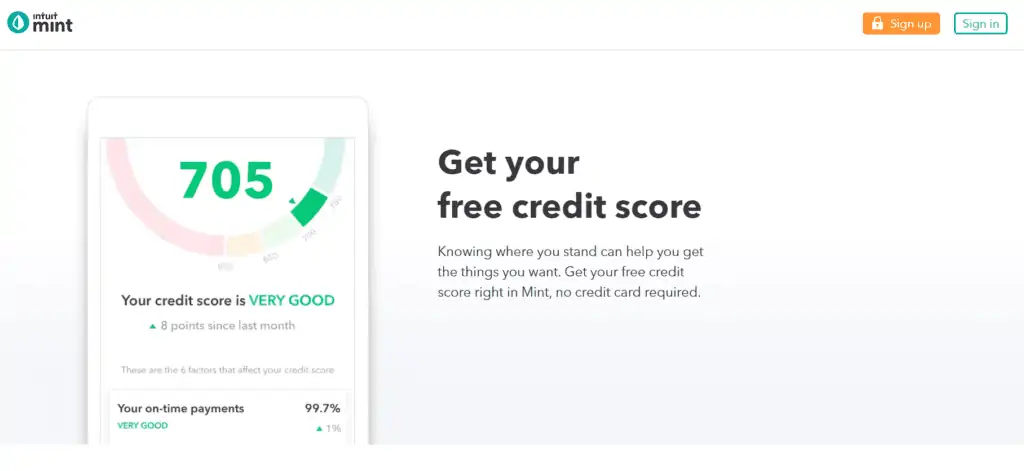

Free Credit Score Tracking

Credit score tracking was recently launched and added to the Mint app, where you can select this feature to help you keep track of your credit standing for your overall financial status. Mint made it easier for you to monitor your financial health by presenting:

- Payment history

- The average age of the credit accounts

- Credit score

To view your credit score, payment history, or credit accounts, you just have to click the “show details” button. This will show you a thorough breakdown of your credit score so you know what contributes the most to your score and possible areas to improve your score.

Investment Tracker

Investments require our attention most of the time, and it’s hard to keep an eye on all of them. That is why you will be happy to know that Mint has an investment tracker to monitor your investments.

This feature can track your investments via your asset allocations and balances. It acts as an extension of your current statements where you can see the status of your retirement funds, and if you go deeper, you get a chance to inspect your investment costs.

Savings

The Mint app offers different ways to save. From opening a savings account to trying out new insurance, Mint provides you with these services to further maximize the monitoring of your finances. Mint also provides you with suggested products and services to boost your savings potential which is tailored to your personal situation.

Pros And Cons Of Mint

Mint is a terrific app for budgeting especially since it has features that can help you with your finances. Here are some of the pros and cons of Mint that will help you learn more about how the platform works.

Pros Of Mint

- Free and easy to set-up

- User-friendly

- Link all your finances in one place

- Helpful notifications

- Free credit score access

- Simple tool for budgeting

Cons Of Mint

- Lack of bill pay feature

- Bank account connections issue

- Ads

How Much Does Mint Cost?

As we’ve mentioned, the Mint app is entirely free to use. They do have ads and partnerships with other companies.

Mint will need to access your data to provide recommendations and suggestions on how to help you save money. Suppose you are paying 18% interest on your credit card, Mint will know this and will provide you suggestions for a new credit card with a balance transfer offer. In that case, they’d get paid for the referral and you get to save money. It’s a win-win situation.

All in all, the Mint app is free while helping you monitor and realize your financial plans. Mint helps you by recommending different ways to save money, pay your debts faster, and lays out ways to reduce your expenses.

How Does Mint Make Money?

Mint makes money by providing its services on the methods on how to save money, earn money, and other financial services. From that, they can get a referral fee. Mints will also introduce ad banners in different parts of their website as a way to monetize their services.

Mint also allows you to sign up for premium access to your credit report when the free credit monitoring system Mint offers isn’t sufficient.

Mints also sells off the aggregate (not individual) financial data to several providers that include information about consumer spending, the average credit card balance, how many retirement accounts users have, and more.

Rest assured that the collected data will be anonymous and will not signify an individual’s personal information. This is done purely for educational purposes on consumer habits.

Is The Mint App Safe?

The Mint app is safe because it is from Intuit. Mint’s parent company employs the latest security and technology measures to ensure that their customer’s personal and financial information is kept confidential and safe from bad elements in the world today.

The security program involves software and hardware encryption and multi-factor authentication. Mint knows and prioritizes the safety of their customers’ information as they promote trust and security for their platform.

Is The Mint App Worth It?

Mint is one of the best tools used for budgeting, tracking expenses and goals, and their tailor-fit solution is also perfect for saving money. Besides that, Mint is an investment platform, which has a tracking feature for your investments and will provide relevant information to your current investments.

Mint users love most of the app’s features. However, some still struggle with the synchronization issues and the lack of bill pay features. This has been an ongoing issue with the Mint app, for example, that it miscategorizes too many transactions.

But rest assured, Mint is working on that as the app used to have in 2018. They do know the importance of this feature and they are working towards addressing these issues and providing only the best service for its growing base of customers.

Alternative Apps Of Mint

If you are still on the fence with Mint but you do know that you need help in monitoring your finances, you can check out some of the alternative apps of Mint. There are a lot of them, but we have picked out the best among the rest.

Personal Capital

Personal Capital is another financial app that allows you to trace your financial statement but has a different feature from Mint, specifically investment advising. To access this, you will have to get the paid version for personal advising.

Its free version has a lot to offer, too, such as access to investment checkups (a tool that allows you to know if your allocated investment is suitable for your current age, projected retirement age, and risk tolerance). You can also create a retirement planner which tells you ways to save money for your retirement goals. This 401K fee analyzer tells you if you pay excessively. And lastly, the hardware encryption and the multi-factor authentication that makes the platform safe to use.

YNAB (You Need A Budget)

YNAB or You Need A Budget, is an app on par with Mint. This app actively helps you take charge of your money by reminding you to give every dollar from your income to your expenses or savings every month.

YNAB relies on three groups: net worth, spending, and income compared to expenses. This app has many promising features that will make you happy, such as allowing you to organize your finances as far as in the coming months as you like.

Signing up to YNAB is simple, and adding accounts is way easier. Although, getting accustomed to the YNAB budgeting ideas and procedures may require you to have more knowledge and experience in financial planning. This app has a 30-day free trial and costs $14.99 monthly or $98.99 yearly with a money-back guarantee.

Start My Free YNAB Trial Today >>

PocketSmith

PocketSmith is an excellent app if you like to estimate your finances into the future. This app lets you create a what-if structure that may reach up to 30 years from now. This is a huge help if you are looking to change your behavior so you won’t end up broke by the time of your retirement.

PocketSmith also functions as your classic financial app that inspects your spending and savings, just like Mint. It also connects all your accounts in one place and helps you realize your finances.

The only disadvantage of using this account is that the free version has a limit, which means you will have to enter your transactions manually. Paid versions update automatically and will cost you $7.50 yearly.

Empower

Empower is the latest app of the same nature and offers you a personal financial space. This app is made user-friendly and provides assistance in saving money and tracking their expenses. They also provide a $250 cash advance without interest and late fees.

Empower is free for 14 days and then asks for a payment of $8 monthly to access the complete features of financial management.

Count About

Count About is an online personal finance budgeting app. This app does offer standard personal finance like aggregating bank account data and lets you create budgets.

However, this app allows you to go deeper into your data and can run reports on almost anything on the platform. Making it easier for you to make changes to control your spending habits.

Unfortunately, CountAbout is only free for 15 days, and if you want to utilize all your transactions and its features, you will have to pay the service costs of $9.99 annually.

If you are a premium holder, importing your transactions will cost you $39.99 per year, but you get to enjoy the privilege of no advertisements popping left and right.

Conclusion – Mint Review

Mint app is a service that aims to cater to the masses. The app helps people to have a greater understanding of their financial standing. Mint provides an opportunity for the everyday person to create their budget in their own way and to track their expenses automatically.

Mint also has different features that you can access, like investment tracking and monitoring. You will also be able to keep track of your credit score regularly so you may make changes as needed with your score.

Mint has a feature that you can utilize and may provide what you want and need in line with your financial plans. Controlling and disciplining your spending habits and monitoring where you put your money regularly is not that easy. We all have been there. And we need all the help we can get.

This is where apps like Mint come in to help us manage our finances. It is a means to an end. So, check it out and have it as a partner for your financial goals.

Founder of Spark Nomad, Radical FIRE, Journalist

Expertise: Personal finance and travel content

Education: Bachelor of Economics at Radboud University, Master in Finance at Radboud University, Minor in Economics at Chapman University.

Over 200 articles, essays, and short stories published across the web.

Experience: Marjolein Dilven is a journalist and founder of Radical FIRE, a personal finance platform, and Spark Nomad, a travel platform. Marjolein has a finance and economics background with a master’s in Finance. She has quit her job to travel the world, documenting her travels on Spark Nomad to help people plan their travels. Marjolein Dilven has written for publications like MSN, Associated Press, CNBC, Town News syndicate, and more.