Are you into real estate investing? Have you considered including this in your investment portfolio? Let’s take a look at an app that may persuade you to finally jump into this money-making opportunity in our Groundfloor review.

When looking for investments, there is a steady stream of platforms and apps that offer a wide variety of assets, products, and services for your needs.

If you are in your financial journey where passive investments will play a key role in your financial goals, then choosing where and what to invest in is very important to realize your plans.

Real estate investment is one of the portfolios investors place their money in nowadays. And this begs the question: where can you find a suitable, effective, and efficient partner for your real estate investment needs?

An app or service that can give you the best deals, offers, and utility for this type of investment strategy. Let’s take a look at an app that may help you with this.

What Is Groundfloor?

Groundfloor is a first of its kind alternative investment platform and mobile app that offers everyone the ability to add SEC-qualified real estate note investments to their portfolios on a fractional basis. Groundfloor was founded by Brian Dally and Nick Bhargava back in 2013 and has quickly gained popularity in the real estate investment industry. The Groundfloor app is in both the Apple App Store and Google Play Store, making it widely available for everyone.

The platform is open to both accredited and non-accredited investors and provides them with a way to build a fully customizable real estate debt portfolio for short-term, high-yield returns. This may be of interest for investors looking to add an extra stream of income in the form of interest repayments on their investments.

It is considered one of the best investment platforms for investors looking to make high returns on short-term real estate debt investments. No prior knowledge is needed to invest or succeed, and Groundfloor has one of the lowest investment minimums in the industry, as you can start investing with only a minimum investment of $10.

But are the claims true and backed up by actual performance and utility? That is what we will share with you in this Groundfloor review.

How Does Groundfloor Work?

Before moving on with the review, let’s look at how Groundfloor works!

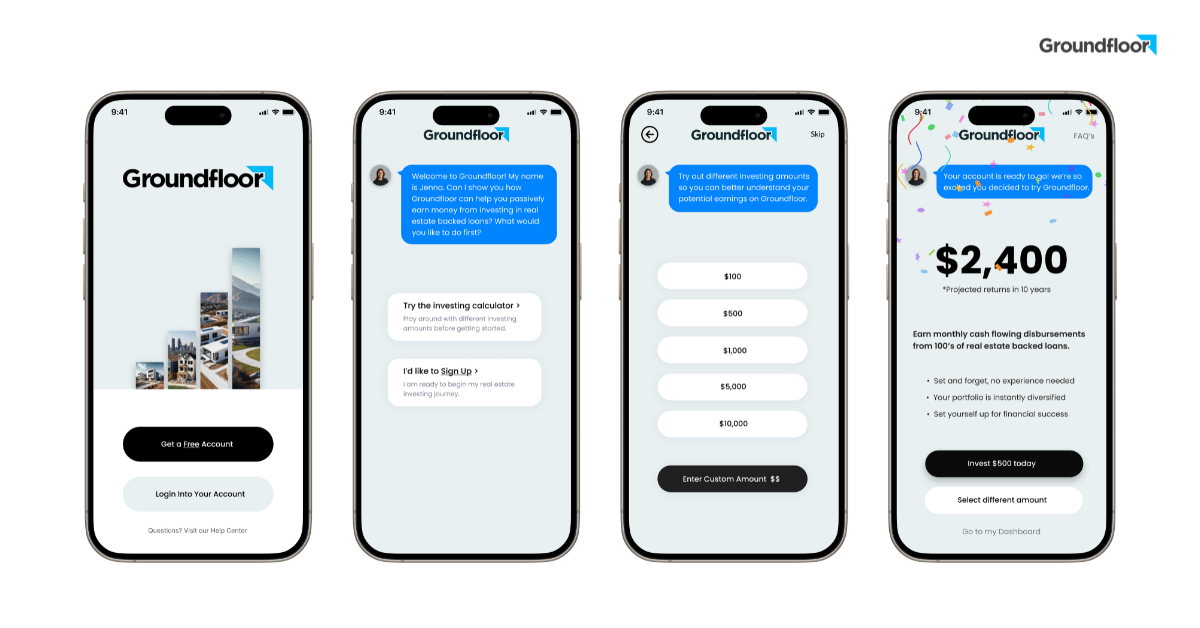

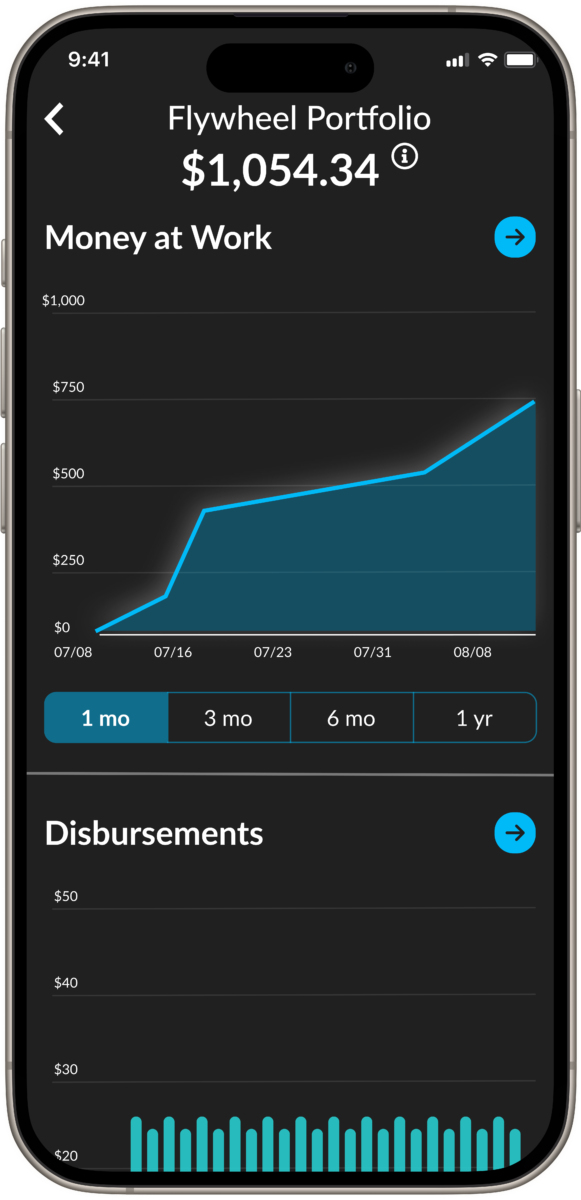

Groundfloor’s model opens private real estate lending to everyone with low barriers to entry. It offers an easy, set-it-and-forget-it experience with their latest product, the Flywheel Portfolio, that launched in October 2024.

All you need to do is create an account, securely connect your bank account through their third-party system, Plaid, and transfer at least $100. Funds will automatically invest in a collection of 200–400 loans, all originated and pre-funded by Groundfloor. The Flywheel is SEC-qualified, and investors can enjoy weekly disbursements, 10% average annualized returns, and instant diversification, mitigating risk.

While there are no upfront fees to invest in the Flywheel, there is a 0.50% to 1% management fee assessed at the time of disbursements. The 10% average returns factor in the fees, and this is still a nominal cost to access these types of private deals .

As of February 2025, there are more than 260,000 registered users on the platform and $1.6 billion has been invested into Groundfloor. Since its launch in 2013, the company has seen its 10% annualized returns with a low loss rate of 0.84%.

Groundfloor’s Analysis Process

At Groundfloor, the process starts with the borrower, who submits a loan application that is carefully reviewed by the Groundfloor team. If accepted and underwritten, the loan will be assigned a risk grade and a corresponding interest rate.

Then, the loan is submitted to the SEC and transformed into an investment security called a Limited Recourse Obligation (LRO), which is then placed on the Groundfloor platform for funding by investors.

Loans That Groundfloor Offers

Groundfloor offers loans of $75K – $2.5M at rates from 2.75-4% of the loan amount, depending on the borrower and project. Loan terms can range from 6-18 months, and borrowers can receive up to 100% Loan-to-Cost and up to 75% Loan-to-ARV, depending on experience.

Groundfloor also offers a unique deferred payment option that gives borrowers the ability to defer all loan and interest payments to the end of the loan term.

Groundfloor charges borrowers a $495 application fee which covers the cost of the valuation process.

Who Can Invest With Groundfloor?

The thing that makes Groundfloor stand out from its competitors, such as Fundrise and Roofstock, is that it has made investment opportunities available to any interested parties: both accredited and non-accredited. Before this, investment opportunities were only presented to accredited individuals with millions in their name. Now, anyone can easily try out the platform, even if they’re new to real estate investing.

With Groundfloor, the average investor can also make investments in individual notes without any hidden charges or fees. There is a minimal fee for the Flywheel Portfolio, but investors are well-informed of it before investing. Groundfloor also offers one of the lowest required amounts of investment in the real estate investing and crowdfunding industry, with people being allowed to put in as little as $100 (although most usually deposit a $1,000 to start).

This low investment minimum also allows investors the ability to easily diversify their portfolios since the Flywheel Portfolio offers instant diversification across hundreds of loans at once. Because of this, your funds are hyper-fractionalized, down to even fractions of a cent, which mitigates your risk.

Similarly, accredited investors are also welcomed to the platform and can invest with any amount they would like.

With this in mind, anyone with some cash to invest can get registered with Groundfloor and start making money passively.

Is Groundfloor Legitimate Or Scam?

Groundfloor has been around since 2013 and has garnered more than 260,000 registered users to date. The platform has seen over $1.6 billion in investor volume across 5,800+projects since 2013. Additionally, the company has won numerous awards for its rapid growth and innovation, including being honored on Inc. Magazine’s Inc. 5000 List with Deloitte’s Technology Fast 500 List, and Forbes Fintech 50.

Although the platform works more like a lending club than a brokerage, it is still very efficient and does exactly what it set out to do. But does that make Groundfloor the best place to invest?

That question is hard to answer as there are no legitimate websites that offer a 100% guaranteed return on investments, and the decision to invest with Groundfloor requires careful analysis.

It’s a good idea to take some time to become comfortable with Groundfloor’s model before you commit money. Luckily, the company’s $100 minimum investment allows you to try the platform out and get a feel for how it works first, without having to tie up too much of your money.

What About Defaults at Groundfloor?

The loans Groundfloor makes to borrowers are known as hard money loans. A hard money loan is a loan backed by a “hard” asset — a tangible property that’s projected to produce a profit to repay the loan quickly. Groundfloor boasts an impressive low loss rate of 0.84% since its founding in 2013.

It’s important to know that the nature of hard money lending can result in a higher chance of defaults compared with other residential loans. This year, 0.6% of properties nationwide have gone through foreclosure, compared to around 2% of properties on Groundfloor. While that may seem like a significant discrepancy, it’s important to note that Groundfloor has historically recovered over 98% of investors’ principal even in default or other special situations. In fact, Groundfloor’s average return rate of defaulted loans is 6%, so investors may still earn a profit.

Additionally, foreclosure laws in most states are typically more favorable toward lenders when it comes to investment properties compared to loans on a borrower’s residence.

Should I Invest In Groundfloor?

The key to successful investing on Groundfloor is diversification, which they have built into the process with their new Flywheel Portfolio. Investors who diversify their portfolios across a large number of loans can still realize high overall rates of return, even when losses occur. This is where the Flywheel stands out with its automatic, instant diversification.

In fact, Groundfloor’s analysis shows that a model portfolio consisting of an equal investment made into all 3,663 loans repaid since the end of 2023 would earn an annualized net return of 9.84%. That same portfolio would have experienced a loss ratio (the principal loss expressed as a ratio of total principal invested) of less than 1%.

If Groundfloor fits your risk appetite, it is a good addition to the diversification of your investment portfolio and can help your investment strategy grow.

Since Groundfloor only deals in a single asset class (residential real estate), you may also want to look into other options like index funds and peer-to-peer investing.

The Pros And Cons Of Groundfloor

Just like everything, there are many good things about the platform. This could be a very good opportunity. So let’s look at some of the pros and cons of using Groundfloor.

Pros Of Groundfloor:

- Easy to use mobile app and web interface with set-it-and-forget-it passive investing

- Since its inception in 2013, Groundfloor has an annualized 10% rate of return and a 0.84% loss rate.

- The minimum required investment is $100, making Groundfloor accessible to everyone.

- While we were trying Groundfloor out for ourselves, we noticed a lot of deals, which speaks for the trust people have and the activity on this platform.

- Your funds are automatically invested across hundreds of loans in the Flywheel, giving you beneficial diversification and lowered risk.

- For people who are not looking to take on huge risks, the platform offers various deals at different risk levels to provide everyone with an opportunity to invest.

- The investors have a minimal fee to pay with the Flywheel, making the whole process more seamless.

- The automatic investment feature makes it easy to put your money to work and keep it working for you while building compounding returns.

- Open to self-directed IRA investments.

- Listed on Forbes Fintech 50 list (2024)

- Ranked in the top 10% (#402) on Inc. Magazine’s 2020 Inc. 5000 List

- Listed on the Inc 5000 list in 2020, 2021, 2022, 2023, and 2024

Cons Of Groundfloor:

- The default rate of loans is a little higher when compared to the trends of the industry by the Federal Reserves.

- If you are a borrower and cannot repay your loan, there is a risk of a foreclosure on your property, though this is a last-resort option.

- There are many loans with high LTVs.

Alternatives To Groundfloor

If you want other choices similar to Groundfloor, you may consider the following alternatives.

Fundrise

Fundrise is an online investment platform that lets you invest in private commercial and residential properties in low-cost and exceptional returns.

The company has two primary investments:

- Electronic Real Estate Investment Trusts (eREITs) – invest in income-generating real estate such as single-family homes, commercial real estate, house flipping, etc.

- eFunds – money from investors that aims to develop new homes, buy land and then sell it to people looking to buy their homes.

If you want to invest in Fundrise, you only need $10 for a Starter Portfolio setup plus a minimum investment of $1,000 to begin your investment journey with them. You also have to pay a 0.15% annual investment advisory fee and a 0.85% annual asset management fee.

Fundrise is excellent with investors with long-term thinking for the market. If you are in the real estate investment game for the long run, this app may be for you.

Roofstock

Roofstock is a platform that offers a marketplace for investors to buy and sell single-family rental properties. These types of investments can let you earn a monthly or regular income to add to your income stream.

Roofstock is very different from Groundfloor and Fundrise as these two offer REITs while Roofstock primarily invests in actual property.

Roofstock is best for those who want to earn in rentals with tenant-occupied properties. So if you want a regular passive income from your property, this may be the best place for you.

Crowdstreet

Crowdstreet is an online investment platform that invests in real estate projects by pairing individual investors with project developers. It allows you to do your own research and choose your own investment criteria. This helps you conduct due diligence before you enter into an investment. It’s a great way to mitigate risks and understand your potential income to consider in your financial plans.

Crowdstreet is free to register. However, you have to pay 0.50% to 2.5% for annual invested capital. This is a small amount to pay for the services that they bring and offer you.

Please take note that Crowdstreet is currently available only for accredited investors. For non-accredited investors, Fundrise may be a fit for you.

Frequently Asked Questions – Groundfloor Review

Now that you know how Groundfloor works, here are some frequently asked questions to help you understand the app more.

How Much Is The Minimum Investment For Groundfloor?

The minimum investment for Groundfloor is $100. This is great as you can widen your investment portfolio with very limited investment risk.

Target returns range from 8% – 15%, with terms ranging from 6 to 18 months, so you need to consider how much you can invest in knowing what you can potentially earn in the long run. Groundfloor also has an annualized average return rate of 10%.

Is Groundfloor free?

Groundfloor offers a small fee for investors in the Flywheel Portfolio (0.5% to 1% management fee assessed after disbursement). There are fees if you want to loan money from them:

- Loan principal – between 2.75%-4%

- Closing costs – $1,250

- Application fee – $495

Is It Safe To Invest In Groundfloor?

Groundfloor platform is safe and legit. But, it is still important that you know that every investment has its own risks. Do your own due diligence and choose the investment that best suits your investment criteria and financial situation.

Conclusion – Groundfloor Review

Groundfloor offers a great way for you to invest in the real estate market. It provides a wide variety of products and services that can help you reach your financial goals, including instant diversification into hundreds of loans, weekly payouts, and compounding returns with automatic reinvesting. But always remember that any investment has its own risks and challenges. So you need to know these first before you dive head-on into your investment journey.

With the proper research, you can make an educated decision as to what path to take. What is important is that you do whatever you can to add to your income so you can attain the financial independence everyone is longing for in their lives.

Always remember, your financial journey is not a sprint but a marathon. So train and educate yourself so that you can prepare yourself better for the path ahead.

Invest now with Groundfloor!

Founder of Spark Nomad, Radical FIRE, Journalist

Expertise: Personal finance and travel content

Education: Bachelor of Economics at Radboud University, Master in Finance at Radboud University, Minor in Economics at Chapman University.

Over 200 articles, essays, and short stories published across the web.

Experience: Marjolein Dilven is a journalist and founder of Radical FIRE, a personal finance platform, and Spark Nomad, a travel platform. Marjolein has a finance and economics background with a master’s in Finance. She has quit her job to travel the world, documenting her travels on Spark Nomad to help people plan their travels. Marjolein Dilven has written for publications like MSN, Associated Press, CNBC, Town News syndicate, and more.

Thanks!

Hey, Nice Info!

I really enjoy reading your posts where I can get such useful information. Thanks for all your advice. It’s invaluable.