Do you want to start investing or feel like you want to try out new brokers? In this BUX Zero review, we’ll go into exactly what the BUX Zero platform is and how you can use it!

This review is written from our experience with the app. We installed the app after hearing that you could get a free share for signing up, with a value of up to €200. After following this link to BUX Zero and making my first deposit, I received the free share.

Here is my detailed review of the app, the pros, cons, and tips when using this platform.

What Is BUX Zero?

BUX Zero, founded in 2019, is built on the BUX platform. With BUX Zero, you can trade for free.

You still have to pay for your stocks, but there are no costs when you buy or sell your stocks. More than 700k people are already investing with BUX Zero. The platform is available in the Netherlands, Germany, Austria, France, Belgium, Ireland, Italy, and Spain.

Almost all competitors charge trading fees when you are buying and selling shares. At BUX Zero, you don’t pay any fees, which is an advantage.

Also, BUX Zero is regulated, so you get an account at ABN Amro that is protected for up to €100.000.

At this moment, BUX Zero is an app-only platform, which means you can only use their platform from your phone. They do this to keep costs low and ensure you don’t have to pay when you’re trading.

BUX Zero As a Small Investor?

Free trading on the platform is an advantage for a small investor. Especially if you just started investing or your monthly recurring investment is still growing. If you invest small amounts, trading fees can take up a significant part of your costs and lower your profits.

For example, let’s say that you invest €50 per month. You buy one share and pay €2 per transaction. That means 12 * 2 = €24 per year. When you invest €600 per year and get an annual return of 7%, your return is €42 in your first year. Paying €24 on transactions is 57% of your profits in the first year.

While €24 per year doesn’t sound like a lot, it can prevent you from letting your money make money. Like Robert Kiyosaki says in Rich Dad Poor Dad, you want to make your money work for you. When you ignore things that decrease your profits, your money will still work for you but in a less efficient way.

BUX Zero has a unique offer, where you get a free share when you sign up with their platform. You get a random share valued up to €200! You sign up with BUX Zero, and you’re an investor with the first share in their portfolio.

Investing in Fractional Shares with BUX Zero

BUX Zero has recently started offering fractional shares with their services. You can now invest from €10 in companies like Google, Apple, or Tesla. Instead of buying one share for €2,370 currently, you can invest €10 in the share.

That’s an amazing advantage Bux Zero has over other platforms like DEGIRO, where you have to buy an entire share.

The new feature allows you to build a more diversified portfolio based on stocks of companies you believe in. Instead of just the stocks you can afford.

Invest in Cryptocurrency with BUX Zero

Bux Zero has also added a cryptocurrency feature to their app. It makes it one of the first brokers that offer stocks, ETFs, and cryptocurrencies – all in one app.

They offer a range of cryptocurrencies, including Bitcoin, Ethereum, and Chainlink, and during the crypto introduction phase, buying and selling cryptocurrencies is commission-free.

The BUX Zero App

The app is super user-friendly and convenient. You transfer money to your bank account and can buy shares with one button click.

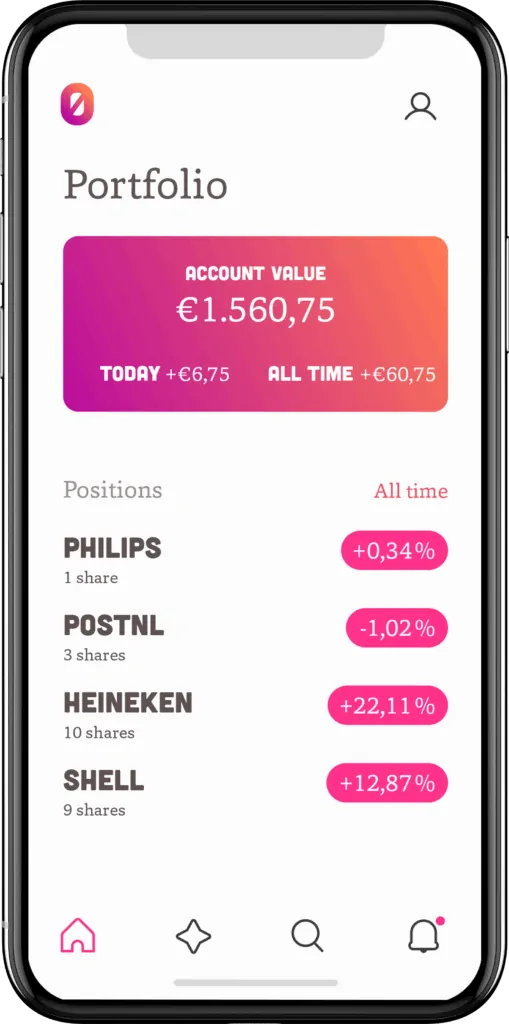

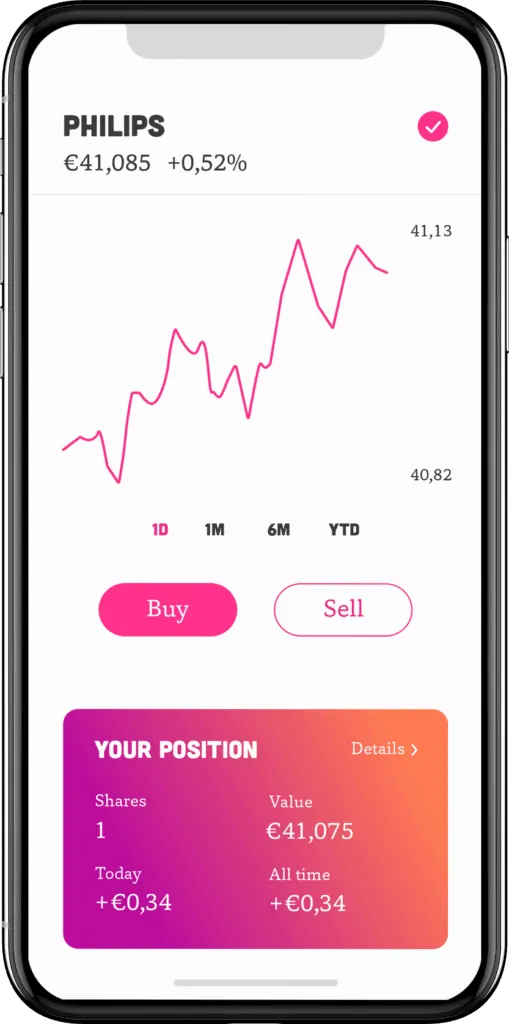

I enjoy the simplicity of the app. It is very intuitive to use and has a clean design so that it is clear how your investments are doing within seconds. Simplicity is key when you’re investing.

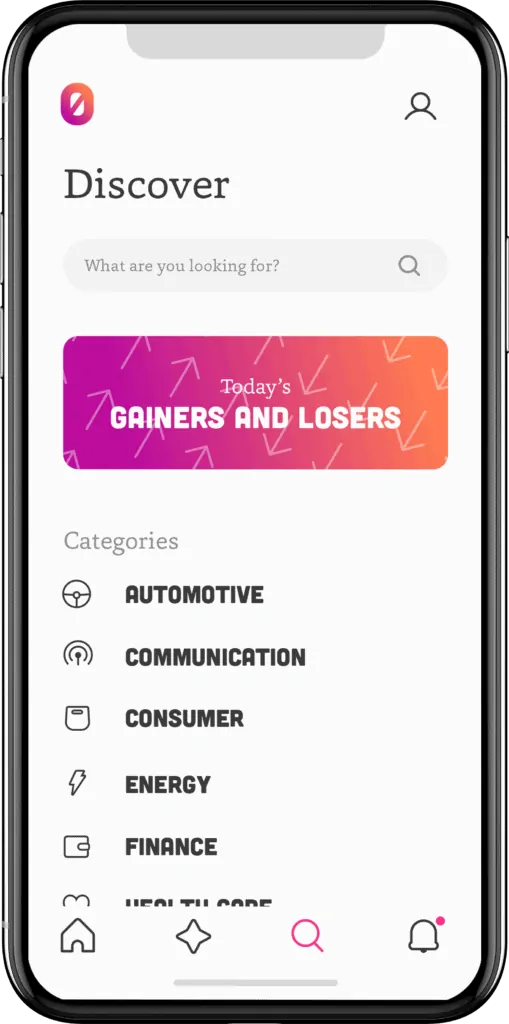

Check below the layout of the app to get an impression of the look and feel:

As you can see, not many analyses are made in the app. However, you can see the graphs and prices of the stocks that you may want to buy. You can add them to your favorites to create your watch list.

On your home screen, you can find your portfolio, watch list, the stocks with the most significant rise or decline in price, shares divided into categories, and your inbox. As you can see in the photo above, the types are automotive, communication, consumer, energy, finance, health care, travel, and technology.

Commission Structure & Trading Fees BUX Zero

While we all love buying and selling our shares for free, BUX Zero needs to make money somehow. So, how are they doing that?

BUX Zero offers three types of orders:

- Market order – your shares are bought directly.

- Limit order – you can determine at what price you want to buy the shares.

- Zero-order – your shares are bought at the end of the trading day.

Here are the trading fees per offer:

| Order Type | EU Shares | US Shares | ETFs | Crypto |

|---|---|---|---|---|

| Zero Order | €0 | €0 | €0 | €0 |

| Market Order | €1,5 | €0 | €1,5 | €0 |

| Limit Order | €1,5 | €0 | €1,5 | €0 |

What are the consequences of trading the Zero Order? If you trade your order at the end of the trading day, it could be that the share price has slightly changed. However, your order will be canceled if the price difference exceeds 5%. Still, depending on the movement, it can impact your investment negatively or positively.

When you’re trading US stocks, there will also be costs for currency exchange. Currently, these fees are 0,35% on your order.

Pros Of BUX Zero

The pros of BUX Zero are:

- Commission-free trading (see commission structure for more information and specifics)

- Free share when signing up for their platform

- Fractional investing

- User-friendly platform

- No minimum deposit required

Cons Of BUX Zero

The cons of BUX Zero are:

- They don’t give investment advice

- You don’t get a demo account

- The app is only available in 8 countries currently

Free Share With Max Value Of €200

Everyone who creates a new BUX Zero account gets a free share. BUX chooses which share you get at random. The share has a maximum value of €200. It can be anything like, for example, Uber, Shell, or Abercrombie.

How Do I Get That Bonus?

To get the bonus, you should:

- Open this link on mobile to open the app store and install the BUX Zero app.

- Create an account and deposit to activate your account. You can decide if you want to invest that amount or get it back later.

- As soon as everything is processed, you get your free share!

Transfer Money Within Seconds

Another cool feature of BUX Zero is that you can transfer money into your account in seconds. How is that? BUX Zero has a partnership with Tikkie, where you can transfer money quickly to your BUX Zero account.

Your money is available within seconds, quicker than the workday you have to wait on other platforms. This feature is only available for Dutch investors for now.

BUX Zero Customer Support

BUX Zero has great customer support, where you can ask all your questions. They offer a live chat function and have FAQ pages on their website and mobile.

You can get customer support in six languages, which may be better if you’re more comfortable in your mother language.

Besides that, I’ve also been in touch with BUX Zero support on their Twitter. And you can contact them through email.

All in all, I’ve never had to wait more than a couple of hours before getting a reply from their end.

Is BUX Zero Safe?

BUX Zero is a legitimate broker that the AFM in the Netherlands regulates. They use segregated bank accounts and have encryption services in place. When you invest at BUX Zero, your capital is protected for up to €100.000.

Is BUX Zero A Good Platform?

When you’re a beginner, BUX Zero is a great platform. They provide you with a free share for signing up, have low trading costs, and protect your money on their platform.

What Are BUX Zero Alternatives?

BUX Zero is located in Europe and is currently only available to a handful of countries. When you’re located in the US, Acorns is a great option for micro-investing. With the Acorns platform, you can round up your purchases and invest that money. You’ll build a portfolio without even missing the money.

DEGIRO may be a better option for you when you’re an advanced investor. The platform also provides low trading fees, gives you some index funds to invest in without fees, and is available in more European countries. I use DEGIRO and have written a detailed DEGIRO review.

Conclusion – BUX Zero Review

I am personally using BUX Zero, and I enjoy the service they offer. You get your money deposited on the platform quickly, and the app works intuitively.

If you are new to investing and want to keep it simple, you don’t wish for too complicated analytics. You want to see how much your investments are worth and what you have. BUX Zero does a perfect job at accommodating you in that.

With time, more and more shares and ETFs are available on the platform. It is quick and easy to buy the shares you want on the platform.

It is free to sign up with BUX Zero, it is possible to trade the platform with zero fees, and you get a free share. Try out the platform and see if it is for you. Step out of your comfort zone and start making money work for you!

Download the FREE BUX Zero app here!

Keep in mind that investing also involves risks. You can lose your deposit.

Founder of Spark Nomad, Radical FIRE, Journalist

Expertise: Personal finance and travel content

Education: Bachelor of Economics at Radboud University, Master in Finance at Radboud University, Minor in Economics at Chapman University.

Over 200 articles, essays, and short stories published across the web.

Experience: Marjolein Dilven is a journalist and founder of Radical FIRE, a personal finance platform, and Spark Nomad, a travel platform. Marjolein has a finance and economics background with a master’s in Finance. She has quit her job to travel the world, documenting her travels on Spark Nomad to help people plan their travels. Marjolein Dilven has written for publications like MSN, Associated Press, CNBC, Town News syndicate, and more.

![BUX Zero Review [2024 Update] - Pros, Cons & Tips](https://radicalfire.com/wp-content/uploads/2023/10/BUX-Zero-Review-2024-Update-Pros-Cons-Tips.png)

Hi Ron, the platform is currently available in the Netherlands, Germany, Austria, France, and Belgium.

Bux seems to be good. One question, is it available in India though? Or is it only available in the United States?

Hi Dio, thanks voor je reactie! Het is een laagdrempelige manier om beleggen toegankelijk te maken voor een grotere groep, dus dat deel doen ze goed. Inderdaad is het investeren in ETFs en indexfondsen goed voor iedere belegger, en ze breiden de beschikbare indexfondsen steeds verder uit! Je kunt ondertussen in een aantal fondsen van VanGuard, iShares, en Lyxor beleggen.

Hmm interessant om te lezen. Ik heb zelf nu ook een tijdje BUX Zero, gewoon voor de fun naast mijn andere brokers, maar ik ben niet echt overtuigd. Leuk dat je een aandeel krijgt, maar ik loop er nog niet zo warm van. Ik beleg liever in fondsen of ETF’s en vind dat hierdoor te veel mensen gaan beleggen die eigenlijk geen idee hebben wat ze doen..