Having a hard time organizing your finances? Why not try the Tally app? Tally helps you manage your debt automatically so that you can pay it back as soon as possible. You will learn more in this Tally app review.

Dealing with your bills and loans can be a hassle, and there’s always the risk of forgetting them. That can lead to paying more because of penalties for delayed payments.

Do you want to pay extra charges? We don’t want that! We want you to save more money rather than having to pay back more debt. That’s where Tally comes in.

We will be discussing how the Tally app works, how it can save you from penalties, interest, and how convenient it is in managing your expenses and assets.

What Is The Tally App?

Tally is an app for your finances. They help you organize your expenses, debt payments, and especially your credit card debt most optimally. You can download Tally on Android and iOS, and this app is tagged as the world’s first automated debt manager.

Tally also helps you save money, manage your credit cards, and pays down your debt faster than doing it on your own. What a relief! You don’t have to worry about paying your bills late because this app is made to let you stay on top of your credit cards.

This app’s purpose is not only to manage your debt but also to ensure that you continuously pay on time, avoid late fees, and lower interest rates to save more money.

How Does Tally Work?

We’ve been hearing how great the Tally app and its many features are, but how does it really work? Let’s learn more about it.

To start with Tally, download and install the app and create an account. Once you’re done, the next thing to do is to link your credit cards.

Tally monitors your credit card’s balances, interest rates, and due dates. It also extends a line of credits that assists you in merging your debt at the lowest interest rate possible.

Then the Tally app will take over your credit cards and expenses if you choose the “Tally Pays” option. This is to ensure that you will not miss a payment. And this app also computes in the smartest way to help you save more cash on interest to all your credit cards.

If you decide to handle the payments by yourself, this app allows that option too. However, you will still receive notifications about deadline payments and how much you should be paying.

Tally is a free app and does not have any in-app purchases, to begin with, and if you want to utilize the full benefits, you will have to apply for a Tally and a Tally line of credit.

Tally lines of credit come with an annual percentage rate (APR) ranging from 7.9% to 25.9%. This rate may have a tendency to fluctuate based on the prime rate, similar to credit card interest rates.

The tally comes with no annual fee, no origination fee loan, No balance transfer fees, no late fees, and no prepayment fees. This app also offers an average lifetime savings of $5,300 per customer.

How Much Can Tally Save Me?

You may be asking yourself how much money you can save by using Tally. Tally saves the average customer using their service a whopping $5,300 of interest.

When you’re hearing that, you may want to consider using the app. You can sign up here.

Is The Tally App For Me?

Tally is for you if you:

- Have gotten yourself into debt and want to be sure you stay on top of payments, to get out of debt as soon as possible.

- Want to get a lower interest rate on your credit cards than you’re currently offered.

- You’re looking to build a solid credit score for years to come.

- When you have a good credit status and you want to make sure that you stay on top of all your future debt, while minimizing the amount of interest you pay.

Tally App Features

Tally has different features that will help you control your assets and bills. Here are some of them:

Debt Manager

The Tally app has a debt manager or also called the “Tall Advisor,” which is their automated advisor. This feature evaluates your current spending habits. In addition, it offers suggested advice on how you can get out of debt faster.

Save on Interest

The save on interest feature helps you save money on interest fees. Tally transfers your higher annual percentage rate (APR) balances to your Tally line of credits.

The lower the APR is on your Tally line of credits, the more you will save money on interest directly.

Late Fee Protection

We all hate to pay late fees, and thus, this app helps us avoid them. Tally inspects your credit card accounts and makes sure that you won’t miss any single payment for your bills.

One benefit of using the Tally app is that when you haven’t missed a payment, they will make the minimum payment on your behalf taken from your Tally line of credit at the lower APR.

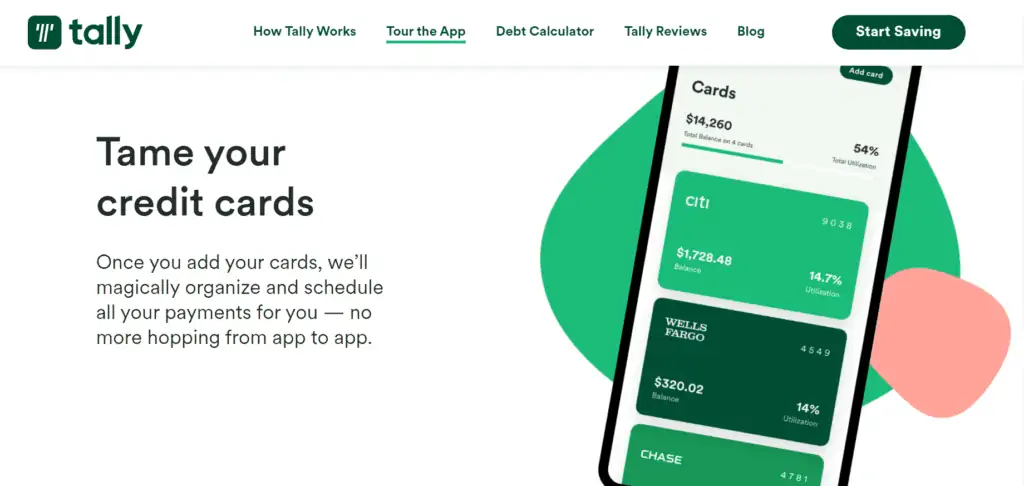

Credit Card Manager

Tally manages all the information of your credit card and puts it in one location rather than having it managed in different places.

Once you add your cards to the app, you can view all of your credit cards in one place. How cool is that!

Line of Credit

Once you’re done installing the app and linking the credit cards you’d like them to help you manage, you will then receive a notification about the process and requirements of being eligible for a line of credit.

By doing so, Tally will analyze your credit profile and determine if they will provide you a line of credit with a lower APR than the one you are currently paying.

How Does Tally Make Money?

Tally makes money from interest charges on the line of credit that expands to consolidate some of your loans. You will be able to save more money when Tally provides you with a lower interest rate than your credit card company does. That’s a win-win!

Tally also uses an algorithm to ensure that every monthly payment is allocated to maximize your interest savings. You don’t pay any money for using the app.

What Kind Of Services Does Tally Offer?

There are many services that you can enjoy using the Tally app, and here are some of them.

Tally Advisor

We’ve mentioned this one earlier: the Tally Advisor is one of the many reasons why people are using the Tally app.

It is a built-in artificial intelligence system that organizes your debt by giving monthly payment recommendations depending on your spending data.

Tally Pays

Tally Pays is known as the solution to any debt problem. Generally speaking, it pays off your debt two days in advance of your monthly due date.

You Pay

You Pay is a service that helps you manage your card payments by offering you an approximation date of when the payment arrives. On the other hand, if you don’t have enough funding in your account and your payment is rejected, you may send the return directly to the issuer using the website or the app.

How Much Does Tally Cost?

You can download the Tally app completely for free, and there is no fee when using the app.

However, the app does charge you interest when you borrow from them, based on the amount you borrow. It’s only fair to do so when they save you money, right? How much does Tally charge? That will be based on your credit history and will be between 739-25.9%.

Other than the interest you pay, there are no recurring annual fees, no payment fees, no late fees, and no overdraft fees.

What Financial Companies Does Tally Work With?

Tally works together with a large number of different credit card companies, like banks and companies that provide credit cards for specific stores. This makes it easier to connect and be able to use their app to save money and get your debt in control.

Here are several credit card companies that Tally is associated with:

- Bank of America

- Capital One

- American Express

- Citibank

- Chase

- Discover

- PNC Bank

- US Bank

- Wells Fargo

- First Bankcard

- Barclays

Store credit card companies:

- Amazon Rewards Visa Signature

- AEO Connected

- AEO Connected Visa

- Amazon Prime Store Card

- Home Depot Consumer Credit Card

- Home Depot Project Loan

- Macy’s Credit Card

- My Best Buy Visa

- My Best Buy Credit Card

- Sears Card

- Sears Mastercard

- TJX Rewards Access

- TJX Rewards Credit Card

Tally gradually adds more companies as they get approvals and partnerships, so be sure to check in from time to time.

Does Tally Affect Your Credit Score?

No, using Tally will not impact your current credit score because the Tally app only processes a soft credit check. As soon as you set up your account and you have to have a FICO score of 660 or higher, you can take advantage of their services.

The Tally app will conduct the verification on different aspects of your credit profile as relatively part of the qualification process, so your credit score is not the sole determiner either.

Is Tally App Legit Or Safe?

Yes, it is completely safe and legit to use Tally. That’s because the Tally app has a secure sockets layer (SSL) encryption, ensuring that it won’t store any of your personal information such as credit card accounts and passwords. The SSL also protects your accounts from third-party users.

Besides, the company’s validity is proven by the customer’s satisfaction ratings which can be found on various platforms such as a B rating on BBB.org and have an overall score of 4.2 out of the 5-star rating on Trustpilot.

In addition, app users enjoy using the Tally and have a rating of 4.5-star on the Apple store and a 4.1-star rating on Google Play. It is a remarkable rank that most of the Tally app’s reviews received, and users also mentioned compliments on the Tally features.

Here are some pros and cons of using the Tall app to help you narrow down whether Tally is the one who can help you with your financial situation.

Pros Of Tally

Do you want to learn more? Let’s start with the positives. Here are the pros for Tally:

Save Money

Saving money is one of the reasons why more and more people are getting into Tally. When you are eligible for a line of credit, you can transfer any credit card balances to a Tally credit line. Suppose that the annual percentage rate is lower, which means you’ll get to save on interest fees to pay off your debt faster.

Tally Does the Calculations For You

The Tally app will look at your credit card balances and determine the best payment amount to make on each, and find out which one you should pay off first.

Secured System

Tally has the secure sockets layer SSL encryption and won’t store your personal information such as passwords. They also won’t sell or share your information without your consent.

No Overlimit Fees

Tally won’t charge you with over-limit fees if you go beyond your maximum amount, and they would still pay your credit card’s minimum payments.

In exchange, you will have to pay the amount they had paid plus the interest by your next Tally credit line due date.

Cons Of Tally

Now let’s look at the other side of the coin so you can get the full picture. This will help you more in making the right decision. Here are the cons for Tally:

Not Beneficial For All Users

Tally may have all the perks you can enjoy. Unfortunately, it is not for all. Tally is convenient for consumers who have a high annual percentage rate (APR) on their credit cards. If you have a promo rate or low annual percentage rate (APR), you’re not going to save any money on interest.

Minimum Credit Score Of 660

To qualify for a line of credit, you must have a credit score of 660 with decent credit history for approval. A few late payments or immoderate card debt will cause you to drop your score below the limit.

Who Can Use Tally?

After all, Tally is a free app and can be downloaded in the Apple App Store and on Google Play. Remember, you must have a credit score of 660 or more to be eligible for the line of credit – this is a fairly considered score on the FICO credit score scale.

As of 2021, the Tally app is available in various states such as:

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Washington D.C.

- Florida

- Georgia

- Illinois

- Idaho

- Iowa

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- New Mexico

- New Jersey

- New York

- Ohio

- Oregon

- Oklahoma

- Pennsylvania

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Wisconsin

While the Tally American express is available in the states in:

- Colorado

- Idaho

- Indiana

- Iowa

- New Mexico

- Oregon

- Utah

- Washington

Tally company also stated that they would be adding more states in the future, so if you don’t live in a state that it currently serves, you have to wait until they can get the approval needed.

Alternative Apps Like Tally

If the Tally app is not a suitable app or you’re having trouble with gaining or maintaining the minimum credit score, there are alternative apps that you can enjoy using, just like Tally.

Here are some of them:

Tally App Vs. Quicken

Quicken is a company that provides an inclusive financial tracking program where the main objective is to reduce your debt factors. This money organizing tool allows you to view your whole financial life in one location, such as your bank accounts, investments, loans, and other financial information.

You pay $47 per year if you want to manage and track your debt on this platform.

Tally App Vs. ZilchWorks

ZilchWorks is handy for consumers who like software that aims at debt depletion online. Their app operates to analyze your debts and detect the fastest and most efficient way to settle them. However, with an annual membership payment of $349, it’s a little pricier than Tally.

Tally App Vs. Credit Karma

Credit Karma is the largest free credit monitoring service in America. It helps you locate your old debts to improve your credit score and helps you save money with lower interest rates. The company makes its money by promoting lenders and other card services to the user to help with their credit.

When talking about Credit Karma, it is always compared with Credit Sesame because they also provide users with their credit score. Find out more in our full article about Credit Sesame vs. Credit Karma.

Frequently Asked Questions – Tally App Review

Here are some of the frequently asked questions that may help you in using the Tally app.

Does The Tally App Cost Money?

The Tally app is completely free. It is free to download on Android and on iOS. But for you to enjoy their many benefits, especially their line of credit, you would need to qualify and subscribe to Tally+.

How Much Is Tally Minimum Payment?

Tally minimum payment is around 2-3% of your Tally balance. To compute this, get 1% of your Tally principal balance. Add any minimum payments Tally made to your cards on your behalf including any past due amounts. At a minimum, your payment would be $25 unless your balance is way below that amount.

Does Tally Impact My Credit Score?

Tally will make soft inquiries on your credit line thus, not affecting your credit score. Tally, in fact, helps you to improve your overall credit score because of its many services.

Does Tally Increase Credit Limit?

The straight answer is no. Because your lender will be the one to approve your higher credit limit requests. But do remember that Tally will help you improve your credit score which can only be done if you have a good credit standing. Once you get a better credit score, you may be able to request a higher credit limit from your lender.

Can I Cancel Tally?

Yes, you can cancel your subscription with Tally at any time. You just need to email the Tally support team or message your Tally account manager about your request to cancel your subscription.

Bottomline – Tally App Review

The bottom line is that the Tally app is for your financial convenience and a great app to use for handling payments, bills, and organizing your financial affairs. With no fee whatsoever and free of charge to use, this app is hassle-free and very favorable!

No more worrying about your personal finance habits and delayed payments, as this app will help you manage all of that. Aside from that, Tally conducts a soft inquiry which means that you can see if you qualify or not without affecting your credit score.

Don’t struggle alone when there are apps that can help you alleviate a portion of your financial burdens. Check out the Tally app and our review articles on different applications that can help you reach your financial objectives.

Try the Tally app now and experience the benefits of managing your finances!

Founder of Spark Nomad, Radical FIRE, Journalist

Expertise: Personal finance and travel content

Education: Bachelor of Economics at Radboud University, Master in Finance at Radboud University, Minor in Economics at Chapman University.

Over 200 articles, essays, and short stories published across the web.

Experience: Marjolein Dilven is a journalist and founder of Radical FIRE, a personal finance platform, and Spark Nomad, a travel platform. Marjolein has a finance and economics background with a master’s in Finance. She has quit her job to travel the world, documenting her travels on Spark Nomad to help people plan their travels. Marjolein Dilven has written for publications like MSN, Associated Press, CNBC, Town News syndicate, and more.