As millennials, a lot of us are scared away from investing by the volatility in the market. Swinging up one day and down the next, wiping out all the gains for the past 6 months. Let’s reconsider the volatility of the stock market in the past so that you can overcome your fear of investing.

Above you can see the S&P 500 returns over the last 15 years. The 2008 crisis showed that the stock market could lose half of its value within a year and a half. Retirements were postponed, homes were sold, and cars were lost.

Also the December 2018 volatility is visible, which is the most recent dip.

What I noticed is that many of my peers took something away from the volatility: don’t ever invest in stock markets.

Let’s Zoom Out

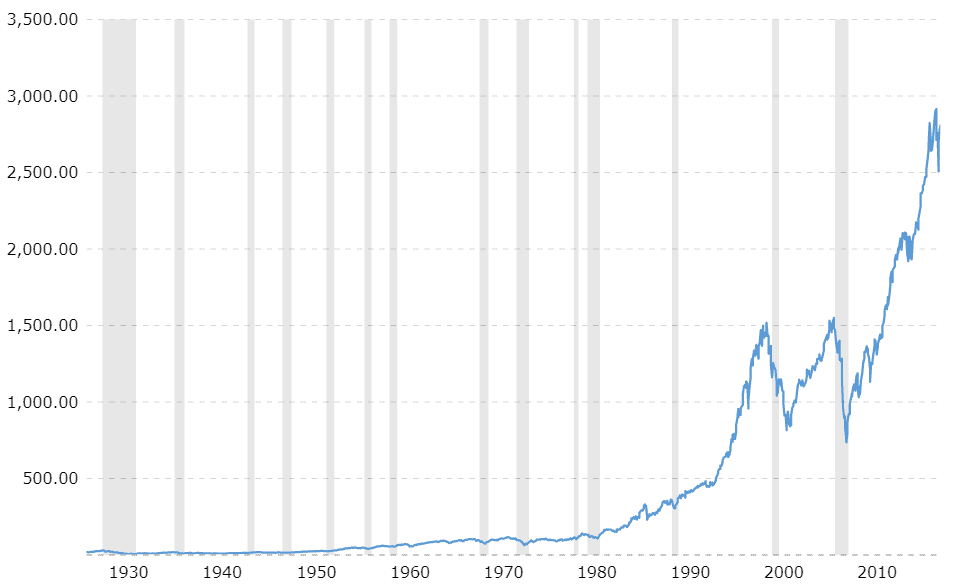

Let’s look at the historical returns of the stock market over a much wider time span.

As you can see much clearer here, the stock market is growing in the long term. Like we’ve discussed before, the historical average growth of the stock market is 7% inflation-adjusted. Which is great honestly!

In Europe, the maximum interest rate you can currently get is 0.55% on a cash or cash equivalent account. That means that you’re missing out when you’re not invested in the stock market.

Yes, there is always the possibility of a market crash, but historically the growth – including market crashes – is 7%. Take that, savings account!

If you’re investing for early retirement, you’re investing for the long term with very little attention to the day-to-day movements. You’re investing every paycheck, trying to grow your portfolio enough on the long term.

It’s not only the growth of your portfolio but also the compound interest component. This means that your money will grow exponentially when you’re returns are reinvested in the market.

You’re one of the millennials is sitting on money but you’re afraid to start investing? You’re trying to time the markets, but end up buying high and selling low? Read on to learn how to overcome your fear of the stock market and start investing!

How to Overcome Your Fear Of Investing

Keep Calm and Invest Long-Term

Invest your money in the stock market for the long run, don’t look at the month to month historical returns. It’s more realistic to look at 5-, 10-year, and 20-year returns.

You want to stay long enough in the stock market to reach financial independence or some other big goal, which makes monthly volatility irrelevant.

Volatility in the market is normal. History tells us that the market is pretty predictable with 7% average yearly growth, but some dips in the market will happen. The amazing this is that the market will always recover, and will probably make us a fair amount of returns over time.

If you want to get rich quick, the stock market isn’t the place to be. But if you’re willing to focus on the long term, the market will most probably earn you some returns.

Especially in you want to be Financially Independent and Retire Early, you will probably be invested in the stock market for multiple decades!

You’re wondering now, what is Financial Independence and Retire Early, you can read more here:

- The Ultimate Guide to Financial Independence and Retire Early

- The Savings Rate Simplified

- What is a Safe Withdrawal Rate for Early Retirement?

- How is Early Retirement Even Possible?

Take the Easy Way – Index Funds

If you’ve read any of my articles about index investing, you know I’m a huge fan of index funds. You don’t have to be a market expert who picks stocks and day trades to invest.

Why? Well, basically:

- You can invest in any market

- You automatically diversify your money

- Even with a low portfolio value

- The costs are extremely low

If there you want to know more about index investing, you can start here:

- Index Funds 101 – Why Low-Cost Index Funds Are Amazing for Your Portfolio

- How to for Investing – The Beginners Guide to ETFs

Be Consistent

If you don’t have the trust in the market yet to bring all your money in the stock market in one go, I would

When you have $10,000 to invest, you might want to go all-in directly. It might be more beneficial for both your sanity and your average return, to take it slow. Instead of investing the $10,000 in one go, you can put in $1,000 every month for 10 months – which is dollar-cost averaging.

In that way, the cost of investing in the market evens out over time. When the market is up you buy less stock and when the market is down you buy more stock, having a great average buying price at the end of the day.

Don’t Check on it Too Much

When you first start investing, you want to check on your investments every second of every day. You want to know what the market is doing and you want to stay up to date. Determined that you can beat the market, you want to buy low and sell high.

Well, that’s not really the best long-term strategy. If you want to day trade, that’s on you, but I’m talking about long-term investing in order to buy a nest egg.

Currently, I check on my investments a few times per week, instead of every hour. I notice that I’m not influenced by the market moves as much. More specifically, I got very excited when the market had a 26% decline in December and I bought extra stock.

If you’re checking your balances a lot, you can try to cut it to a few times per week and see how you feel. Probably you will feel way more relaxed!

Time In the Market Beats Timing the Market

You’ve probably heard this beautiful quote: “Time in the market beats timing the market”. I’ve heard many people say that someday they will start. Well, I think ‘someday’ is a place where a lot of hopes and dreams are waiting to be realized. Don’t be that person, start investing TODAY!

If you’re investing now and getting returns, every dollar is a dollar that you won’t have to earn at your job later!

Focus on your goal

To keep going in the long term, picture what you’re investing this money for. Your goal is to retire? Picture the dream house you will buy. Your goal is to send your kids to college? Picture them having fun with their peers in their dream university. Your goal is to have a mini-retirement? Picture yourself traveling in South America, or whatever your goals are.

The more tangible your goals are, the more appealing they will be and the harder you want to work for them!

If you’re still not convinced to invest in the stock market, I advise you to load up on index funds!

Are you already invested in the stock market? Did you need to overcome some hurdles to start?

Founder of Spark Nomad, Radical FIRE, Journalist

Expertise: Personal finance and travel content

Education: Bachelor of Economics at Radboud University, Master in Finance at Radboud University, Minor in Economics at Chapman University.

Over 200 articles, essays, and short stories published across the web.

Experience: Marjolein Dilven is a journalist and founder of Radical FIRE, a personal finance platform, and Spark Nomad, a travel platform. Marjolein has a finance and economics background with a master’s in Finance. She has quit her job to travel the world, documenting her travels on Spark Nomad to help people plan their travels. Marjolein Dilven has written for publications like MSN, Associated Press, CNBC, Town News syndicate, and more.

![Get Over Your Fear of the Stock Market [& Start Investing]](https://radicalfire.com/wp-content/uploads/2023/12/Get-Over-Your-Fear-of-the-Stock-Market-Start-Investing.png)

Thanks for your reply B, appreciate it!

Yes, the 7% is inflation adjusted – so after inflation.

In addition, yes, most of the time the odds are that the market is going up and that it’s best to invest all your money now. I think that lots of people that are trying to time the market end up buying high and selling low. In this case, DCA has the potential to make a positive impact on their returns. I think DCA has the potential to eliminate fluctuations over time and emotion, so you’re right a nuance should be placed indeed!

Great article, and your main argument is true; you should get over your fear and just invest.

One nuance should be places though: DCA is not better for you returns. Since the market goes up more than it goes down (otherwise the long-term average would not be 7%, which is after inflation by the way), mathematically it’s always beneficial to go all-in as soon as you receive the money.

Yes you might invest just before the market crashes, but chances are higher that you will make more money this way.